Below is a summary of some of the key changes since our June 2024 newsletter. Please note that this isn’t necessarily a complete list of all law changes relevant to your organisation.

What laws have changed recently?

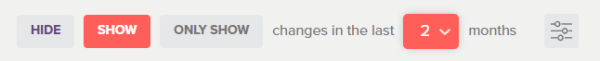

To get full clarity about legislative changes affecting your organisation, dial up the ‘clarity of change’ function in your ComplyWith Obligations Register.

While you’re there, turn on law change notifications for yourself and remember that in the ComplyWith Admin module you can set up tailored law change notifications for anyone in your organisation who will benefit from being kept up to date about law changes relevant to their role.

Key changes for all sectors

- On 31 July 2024, Part 3 of the Taxation (Budget Measures) Act 2024 came into force and increased personal income tax thresholds (except for the highest threshold).

Key changes for public sector organisations

- On 7 August 2024, the Government Workforce Policy Statement 2024 replaced the Government Workforce Policy Statement 2021.

Key changes for local government

- On 2 August 2024, the Sale and Supply of Alcohol (Winery Cellar Door Tasting) Amendment Act 2024 added winery cellar doors to the categories of premises for which territorial authority licensing committees can issue an off-licence.

- On 31 July 2024, the Local Government (Electoral Legislation and Māori Wards and Māori Constituencies) Amendment Act 2024 came into force and placed requirements on councils that established (or resolved to establish) Māori wards or constituencies without conducting a binding poll.

- On 1 July 2024:

- The income threshold for a rates rebate increased from $30,100 to $31,510, and the maximum rates rebate increased from $750 to $790.

- The Local Government Members (2024/2025) Determination 2024 replaced the Local Government Members (2023/2024) Determination 2023.

- The Waste Minimisation (Information Requirements) Amendment Regulations 2023 and Waste Minimisation (Calculation and Payment of Waste Disposal Levy) Amendment Regulations 2023 introduced new record-keeping requirements.

- The Waste Minimisation (Waste Disposal Levy) Amendment Act 2024 incrementally increased waste disposal levy rates for the 2025/26, 2026/27, and 2027/28 financial years.

- The Environmental Performance Measures Record-Keeping Requirements for Drinking Water and Wastewater Network Operators 2024 replaced the Environmental Performance Measures Record-Keeping Requirements for Drinking Water Network Operators Notice 2023.

- The Building (Levy) Amendment Regulations 2024 increased the threshold at which building levies become payable from $20,444 including GST to $65,000 including GST (for building consents granted from 1 July 2024).

- The Land Transport Management (Repeal of Regional Fuel Tax) Amendment Act 2024 ended the Auckland regional fuel tax (RFT) scheme and repealed the framework for establishing and operating RFT schemes.

- The Food (Fees, Charges, and Levies) Amendment Regulations 2024 continued a territorial authority’s power to exempt, waive, or refund fees until 30 June 2029 (previously this power ended on 30 June 2024).

Key changes for the gas industry

- On 1 July 2024:

- The Gas (Levy of Industry Participants) Regulations 2024 set levies on gas industry participants for the 2024/25 financial year.

- The Notification of Levy Rates Under the Energy (Petrol, Engine Fuel, and Gas) Levy Regulations 2017 Notice 2024 decreased the gas safety, monitoring, and energy efficiency levy from 6 cents to 5.3 cents for every gigajoule.

Key changes for residential property owners

- On 31 July 2024, the bright-line tax period was restored to 2 years for residential property sold on or after 1 July 2024 (it was previously increased to 10 years or 5 years for new builds).

- On 1 July 2024, the healthy homes standards under the Residential Tenancies Act started applying to Kāinga Ora and registered community housing providers.

Key changes for creditors under a credit contract

- On 31 July 2024, the detailed requirements for carrying out affordability assessments were removed from the Credit Contracts and Consumer Finance Regulations, and updated guidance on these assessments was added to the Responsible Lending Code.

Key changes for the health sector

- On 15 August 2024, the Specified Prescription Medicines for Designated Registered Nurse Prescribers Notice 2024 replaced the Specified Prescription Medicines for Designated Registered Nurse Prescribers Notice 2022.

- On 5 July 2024, the Misuse of Drugs (Medicinal Cannabis) Amendment Regulations 2024 changed the minimum quality standard for medicinal cannabis products.

Key changes for the early childhood sector

- On 10 August 2024, the Regulatory Systems (Education) Amendment Act 2024 came into force, requiring limited-attendance child-care centres to obtain and consider a Police vet for workers before they start working at a centre.

- On 27 June 2024, the Education (Early Childhood Services) Amendment Regulations 2024 removed the requirement for a person responsible for a licensed early childhood centre (other than an excluded service) to hold a full practising certificate from 26 August 2024.

What’s coming up?

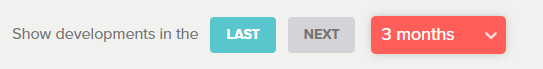

Below is a summary of some of the key changes coming up.

- On 30 August 2024, the Imports and Exports (Restrictions) Prohibition Order (No 2) 2004 Amendment Order 2024 comes into force.

- On 1 September 2024, the Electricity (Prescribed Classes of Registration for Electrical Workers) Notice 2023 and Electricity (Prescribed Requirements for Competence Programmes) Notice 2023 come into force.

- On 3 September 2024, requirements in the Resource Management (Measurement and Reporting of Water Takes) Regulations 2010 will apply to water permits under which water is taken at a rate of 10 or more litres/second but less than 20 litres/second.

- On 14 September 2024, the Notice of National Policy Statement for Highly Productive Land 2022 Amendment No.1 comes into force.

- On 1 October 2024, section 49(6) of the Local Government Electoral Legislation Act 2023 comes into force and will allow local government members attending meetings remotely to be counted as present.

- On 27 October 2024, further provisions of the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021 come into force.

- On 30 October 2024, the Electricity Industry Participation Code Amendment (Hedge Disclosure Obligations) 2024 comes into force.