Below is a summary of some of the key changes since our March 2024 newsletter. Please note that this isn’t necessarily a complete list of all law changes relevant to your organisation.

What laws have changed recently?

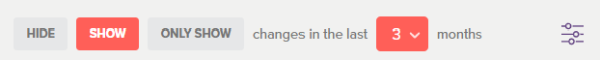

To get full clarity about legislative changes affecting your organisation, dial up the ‘clarity of change’ function in your ComplyWith Obligations Register.

While you’re there, turn on law change notifications for yourself and remember that in the ComplyWith Admin module you can set up tailored law change notifications for anyone in your organisation who will benefit from being kept up to date about law changes relevant to their role.

Key changes for all sectors

- On 5 June 2024, Part 1 of the Taxation (Budget Measures) Act 2024 changed the formula for calculating fringe benefit tax payable under the attribution method. The change has effect from 1 April 2024.

- On 1 June 2024, the second stage of the amendment regulations under the Anti-Money Laundering and Countering Financing of Terrorism Act came into force.

- On 25 April 2024, the Credit Contracts and Consumer Finance Amendment Regulations 2024 came into force.

- On 1 April 2024:

- The minimum wage increased from $22.70 an hour to $23.15 an hour (and from $18.16 an hour to $18.52 an hour for starting-out workers and trainees).

- The student loan annual repayment threshold increased from $22,828 to $24,128.

- The Road User Charges (Light Electric RUC Vehicles) Amendment Act 2024 came into force requiring light electric vehicles to pay road user charges.

Key changes for local government

- On 17 June 2024, the Building (Accreditation of Building Consent Authorities) Amendment Regulations 2024 came into force and changed the building consent authority (BCA) accreditation criteria and standards.

- On 30 May 2024, the remaining provisions of the Sale and Supply of Alcohol (Community Participation) Amendment Act 2023 came into force.

Key changes for the electricity industry

- On 17 June 2024, the Electricity Industry Participation Code Amendment (Transmission Pricing Methodology Related Amendments) 2024 came into force.

- On 1 June 2024, the following came into force:

- Electricity Industry Participation Code Amendment (Definition of Connected Generation) 2024

- Electricity Industry Participation Code Amendment (Updating and Clarifying Part 6A Obligations) 2024.

- On 1 May 2024, the Electricity Industry Participation Code Amendment (Controllable Load) 2024 changed Technical Code B in Schedule 8.3 of the Code.

- On 10 April 2024, the Electricity Industry Participation Code Amendment (Benefit-based Charge Adjustment Event: New Customer) 2024 changed the transmission pricing methodology (TPM) in Schedule 12.4 of the Code.

- On 1 April 2024:

- The Electricity Distribution Information Disclosure (Targeted Review 2024) Amendment Determination 2024 came into force.

- Electricity Information Exchange Protocol (EIEP) 5A became a regulated mandatory EIEP.

- Part 3 of the Schedule in the Electricity (Low Fixed Charge Tariff Option for Domestic Consumers) Regulations 2004 came into force.

Key changes for the health sector

- On 12 April 2024, the Misuse of Drugs (Pseudoephedrine) Amendment Act 2024 came into force and reclassified pseudoephedrine from a Class B2 to a Class C3 controlled drug.

Key changes for organisations with animals

- On 1 April 2024, freshwater farm plan requirements for specified areas in the Manawatū-Whanganui region came into force in line with the Resource Management (Application of Part 9A—Freshwater Farm Plans) Order 2023.

Key changes for organisations involved with dams

- On 13 May 2024, the Building (Dam Safety) Regulations 2022 came into force and introduced obligations on regional authorities and dam owners for ‘classifiable dams’.

Key changes for the early childhood sector

- The Mātauranga (He Anga Marau Kōhungahunga) Pānui 2023 / Education (Early Learning Curriculum Framework) Notice 2023 replaced the Education (Early Childhood Education Curriculum Framework) Notice 2008.

Key changes for adventure activity operators

- On 1 April 2024, the following came into force:

- Health and Safety at Work (Adventure Activities) Amendment Regulations 2023

- Safety Audit Standard - Safety management system requirements for adventure activity operators August 2023 (version 2.0).

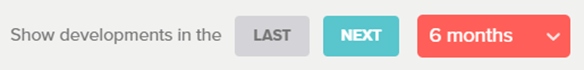

What’s coming up?

Below is a summary of some of the key changes coming up.

- On 1 July 2024, the following come into force:

- Further provisions of the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Act 2024

- Part 2 of the Taxation (Budget Measures) Act 2024

- Rates Rebate (Specified Amounts) Order 2024

- Building (Levy) Amendment Regulations 2024

- Most provisions of the Land Transport Management (Repeal of Regional Fuel Tax) Amendment Act 2024

- Waste Minimisation (Calculation and Payment of Waste Disposal Levy) Amendment Regulations 2023

- Waste Minimisation (Waste Disposal Levy) Amendment Act 2024

- Waste Minimisation (Information Requirements) Amendment Regulations 2023

- Gas (Levy of Industry Participants) Regulations 2024.

- On 18 July 2024, the Financial Service Providers (Rules for Approved Dispute Resolution Schemes) Regulations 2024 come into force.

- On 31 July 2024, the following come into force:

- The remaining provisions of the Credit Contracts and Consumer Finance Amendment Regulations (No 2) 2024

- Part 3 of the Taxation (Budget Measures) Act 2024.